Importance of Carbon Credit

- The application of Carbon credit in Asian countries is gaining a lot of interest in the context that they are the centers of industrial output worldwide and aim to reduce carbon emissions. Global food security and human well-being will suffer greatly if temperatures rise by more than 1.5 degrees Celsius over the next five years, as reported by COP28 figures, which indicate that the situation related to climate change is getting worse. Carbon credits, therefore, are a certificate that indicates the responsibility of nations and enterprises towards climate change and is no longer a factor controlled by economic interests. Instead, they are certificates that may be purchased and sold.

Which industry produces the most carbon?

- The Intergovernmental Panel on Climate Change estimates that power plants—particularly coal-fired power plants—account for 34% of global emissions, followed by industry (24%), transportation (15%), agriculture, forestry, and other land use (22%), and buildings (6%).

How are carbon credits valued?

- The amount of CO2 (or similar greenhouse gas emissions) that is decreased or not raised by a project or activity is determined by a number of intricate calculations. This is dependent upon the project’s scope (e.g., energy conversion, afforestation, or renewable energy projects). The emissions flow in the base case was calculated using particular historical data and formulae. Subsequently, the quantity of avoided emissions is converted into carbon credits by calculating the difference between previous emissions and projected future emissions.

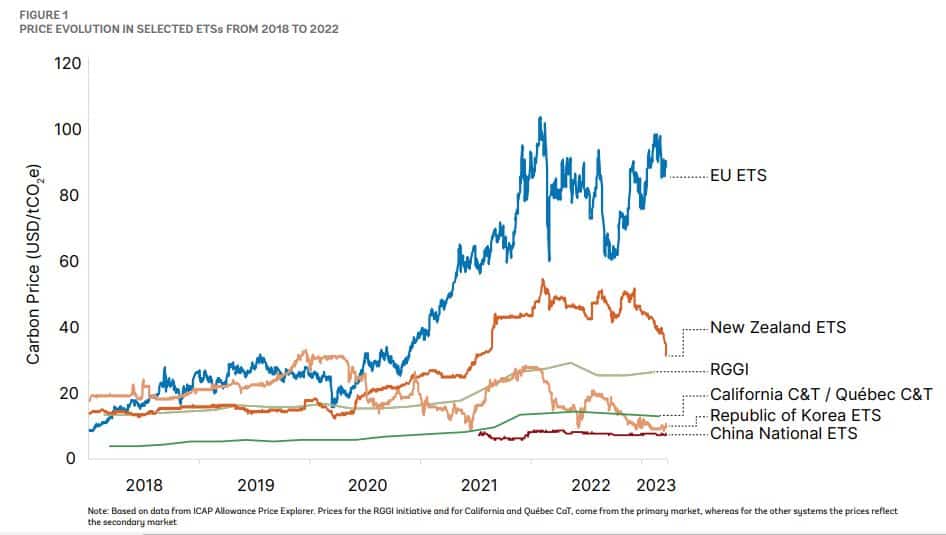

Carbon Credit Markets in the World

- The EU ETS, the largest carbon credit market in the world at the moment, is located in European nations. Additionally, the US maintains a market for power plant carbon credits called RGGI. The cost of carbon credits is relatively high in the US and European markets. The cost of a carbon credit in the EU is currently estimated to be around US$76/ton in 2024 and will likely rise to US$160/ton the following year. The cost of a carbon credit in the US market is projected to rise from approximately US$42/ton in 2024 to approximately US$46/ton in 2025.

- Given that China is the nation with the highest emissions, the carbon credit market (ETS) in China was founded in 2021 and has the potential to grow into one of the largest carbon credit markets globally. Currently, more than 2,200 electricity-related businesses are drawn to this sector; together, these businesses are responsible for 40% of China’s yearly carbon emissions. In China, the cost of a carbon credit varies between US$7 and US$8/ton, and this trend is expected to continue in the near future.

- The carbon credit market is expanding at one of the quickest rates in Southeast Asia. The Singapore Economic Development Board projects that the carbon credit market in Southeast Asia will grow to US$10 billion by 2030. At the moment, Singapore is setting the standard for this trend.

Carbon Credit Market in Vietnam

- Because the carbon credit market in Vietnam is still in the process of developing, businesses find it challenging to afford the price at which they must purchase carbon credits. On the other hand, the government intends to pass legislation pertaining to carbon credits by 2027 and formally launch a carbon credit trading market in 2028. About 1,912 firms nationwide have satisfied the 2023 emission quota and implemented greenhouse gas inventory, according to the Department of Climate Change, Ministry of Natural Resources and Environment.

- A coal-fired power station with a 100 MW capacity and a 55% efficiency can be used as an example to estimate the cost of carbon credits. At full capacity, the plant emits around 480,000 tons of CO2 annually. If the credit price of US$7-8/ton is applied, as it is in the Chinese market, this coal-fired power plant’s operational costs will rise by around VND90-100 billion annually. Evidently, this expense is significant and has the potential to reduce the majority of the plant’s earnings. Therefore, domestic businesses will need to act swiftly to discover ways to cut emissions until carbon credits are formally operated in an obligatory manner.

References

KTSG Online,. (2024). Tín chỉ carbon – Bước hội nhập của Việt Nam.

World Bank,. (2023). State and Trend of Carbon Pricing 2023.